The Meritocracy Tax: A Simpler, Fairer System for All

It's time to replace our broken, 70,000-page tax code with a system so simple and fair, it practically runs itself.

A Solution for a Nation in Crisis

Today, we build. This is a complete rethinking of our tax system. I call it the Meritocracy Tax. It’s simpler, fairer, and more aligned with American values than the broken system we have today.

Before we dive into the mechanics, let’s be blunt about why this isn’t just an academic exercise. Look around. We are staring down the barrel of a recession. Wealth inequality is the highest it has ever been. We have an affordability crisis, a personal debt crisis, a healthcare crisis, a student debt crisis, and a food insecurity crisis.

These aren’t separate problems; they are symptoms of a single, broken system designed to funnel wealth to the top while leaving everyone else to fight for scraps.

There has never been a more urgent moment to find a real solution. The proposal that follows isn’t just a new tax; it’s a new engine for the economy designed to tackle all of these crises at their root.

It’s Time to Evolve Again

There was a time when tariffs paid the nation’s bills—though ironically, some politicians now want to drag us back to that era, pretending it’s a path forward. Then came the income tax—a revolutionary system for a modernizing economy. For nearly a century, it worked, more or less.

But we have clearly outgrown it.

You can see it in the endless complexity of rules for wages, capital gains, real estate, and corporate income—each with its own rates and loopholes. You can see it in the army of accountants and lobbyists built to reshape those rules. And you can see it in the result: a system so distorted it allows billionaires to pay proportionally less than teachers and nurses.

That’s not just inefficient. It’s unjust. It’s time to evolve again.

The Core Principle: A Choice to “Spend” or “Keep”

Let’s start from first principles. When you earn income, you can do one of two things with it:

Spend it: You reinvest it back into the economy by buying food, housing, services, or investing in a business. This circulation is the lifeblood of a healthy capitalist system.

Keep it: You extract it from circulation and convert it into private wealth—savings, stocks, property, etc.. This is the portion of the economy you’ve chosen to retain and control for yourself.

Our current system gets this backward. It primarily taxes income, which often penalizes people who are reinvesting 100% of their resources back into the economy just to live. We’re disincentivizing the very activity capitalism depends on.

Here’s what that looks like in practice. Two people each earn $100,000. Person A spends all of it—on housing, food, services, maybe a vacation. Person B spends $60,000 and keeps $40,000.

Person A generated $200,000 in economic activity: $100,000 flowing to them as income, then $100,000 flowing back out as spending that becomes someone else’s income. At the end of the year, Person A has kept nothing. They cycled everything back through the economy.

If your instinct is to object that both people only “really” contributed $100,000 because that’s how GDP accounting works—you’ve just proven the point. GDP measures production. We’re measuring something different: who walked away with power over resources, and who put everything back. That’s what taxation should be based on.

Person B generated only $160,000 in activity. By keeping $40,000, they extracted that much from circulation—privatized it into personal wealth.

Now look at how the current system treats them: Person A, who participated in more economic activity, pays more in income and sales taxes. Person B, who participated in less activity, pays less—and walks away with $40,000 in accumulated wealth.

The current system taxes the game instead of the winnings—punishing everyone still playing while the biggest winners walk away paying the least.

The Meritocracy Tax flips this script. It’s based on a simple, fair choice. Did you spend all your income? Great. You’ve already put it all back to work in the economy, and you owe no tax. But if you chose to keep a portion—to extract it and build your personal wealth—the system asks for a contribution in proportion to the share of society’s resources you’ve retained.

The Elegant Solution: A “Single Lever” System

So, how do we make that contribution fair, predictable, and meritocratic?

We anchor it to a stable, real-world benchmark: the average long-term return of the S&P 500 (historically around 8% when adjusted for inflation). To ensure this benchmark is exceptionally stable and predictable, it would be calculated as a rolling average over a long period, such as 20 years. This smooths out the volatility of recessions and booms, creating a reliable rate that reflects true economic growth. This becomes the maximum tax rate—the single lever in the entire system.

The logic is simple and powerful:

If your wealth grows faster than the market, you’re rewarded for your skill and contribution. Your wealth grows.

If you simply match the market (say, by investing in an index fund), your wealth stays intact, even after taxes.

Only if your wealth sits idle and unproductive, growing slower than the market, does it shrink slightly, reflecting a fair contribution back to the society that enabled its creation.

This isn’t a penalty on success. It’s a system that rewards contribution, respects choice, and ensures fairness—not through force, but through proportion.

The Reality Check: Modeling a Fair System

To turn this principle into policy, we first need an honest picture of our economy. A theoretical model isn’t enough; it has to be grounded in the real world. That’s why I’ve spent the better part of a year building a computational model using publicly available datasets from the Federal Reserve Economic Data (FRED) repository.

This isn’t a political guess; it’s a mathematical snapshot of our economic reality, and it shows just how concentrated wealth has become

.

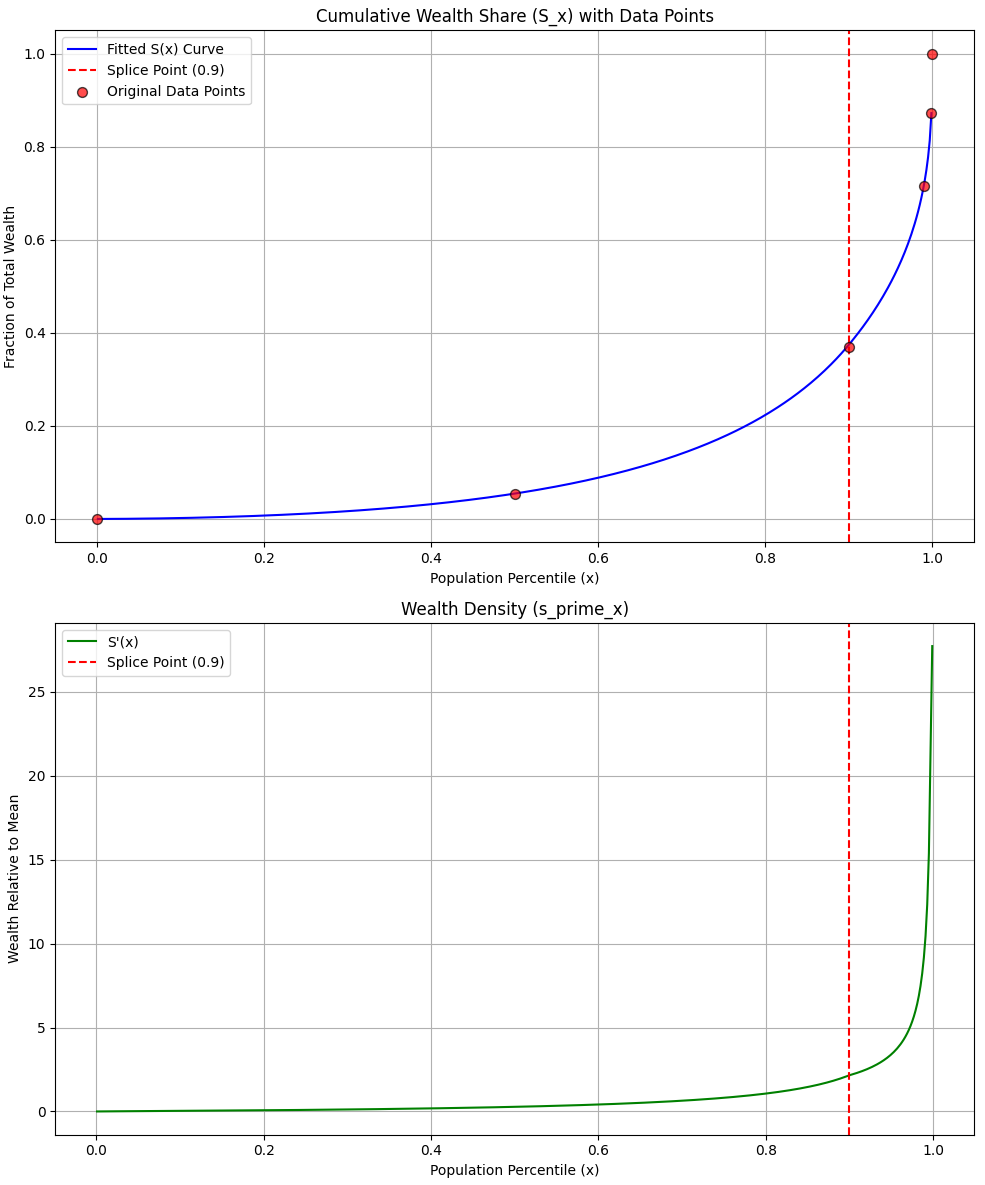

As you can see in the top graph, the blue curve represents the cumulative wealth held by the population. Following it to the 0.9 mark on the horizontal axis, you’ll see it shows that the bottom 90% of Americans hold just 36.9% of the nation’s wealth. Half of Americans, the bottom 50%, hold only 5.4% of the country’s wealth.

This means the wealthiest 10% of the population holds the remaining 63.1%.

The bottom graph tells a more personal story. It illustrates what’s known as wealth density, and its message is even more stark: for a vast swath of Americans, individual wealth is effectively zero. You can see this in the long, flat line that barely lifts off the floor for the majority of the population. Then, as it approaches the top few percentiles, the line rockets upward, showing that the wealth of an individual at the top isn’t just a little more than average; it’s dozens of times greater.

These figures aren’t just my model’s conclusion; they are a direct reflection of the latest analysis from the Federal Reserve itself. This is the truth a fair system must be built on.

The Engine of Fairness: How the Tax Works

So, we have a picture of the nation’s wealth and a maximum tax rate. But how does the system actually determine what any given person pays?

The core principle is proportionality. Your contribution to the national budget is directly proportional to your share of the nation’s taxable wealth.

Why wealth? Because whatever form it takes—cash, stocks, real estate, a business—accumulated wealth represents private control over a slice of the economy. Resources and decision-rights you can withhold, deploy, or pass on. In a word: power. Your responsibility to fund the society that made that accumulation possible should be proportional to how much of that power you hold.

A note on corporate wealth: under this system, corporate income tax also disappears—but corporate wealth doesn't go untaxed. Through rigorous beneficial ownership tracking, every dollar of retained earnings and appreciating corporate assets is attributed to its true owners: shareholders, partners, beneficiaries. The Meritocracy Tax is collected at the individual level. No hiding behind corporate structures. No shell companies. No trusts or partnerships that obscure the beneficial owner—complex structures are collapsed to their true owners following existing anti-abuse doctrines. The entity is transparent; the person pays.

Think of it like this:

First, we establish the exemption level (which we’ll reveal in a moment).

Imagine all the wealth in the country that sits above that exemption level is gathered into one big conceptual pool. This is the “National Taxable Wealth Pool.”

Your personal taxable wealth (your net worth* minus the exemption) is your “stake” in that pool.

We simply calculate what percentage of the total pool your stake represents.

You are then responsible for that exact same percentage of the national budget.

* Debt only reduces your net worth when it finances an asset that still exists. Borrow to buy a house, and the debt offsets the house's value. Borrow to fund consumption, and you still owe your share—you can't shrink your obligation by spending someone else's money.

For example, if the total taxable wealth in the country is $100 trillion and your personal taxable wealth is $1 million, you hold one-millionth of that pool. Therefore, you are responsible for paying one-millionth of the national budget.

This is what makes the system so fair. It’s not an arbitrary rate pulled from a complex table; it’s a direct reflection of your economic footprint. The bigger your slice of the taxable pie, the bigger your responsibility for maintaining the society that enabled you to acquire it.

Now, while this principle of proportionality is the engine, the “Single Lever” system we discussed earlier (the 8% benchmark) acts as a crucial safety valve. The final calculations ensure that even with this proportional system, the tax on your productive assets never exceeds that benchmark, preventing punitive rates and rewarding merit.

With that principle in mind, let’s look at the final numbers.

The Big Reveal: Calculating the Exemption

With the principle of proportionality as our engine, we can now answer the most important question.

Given the 2024 federal budget of $6.66 trillion, what is the exact wealth exemption every adult would receive before paying a single dollar in tax?

Our model solves this by tying the exemption to a measure of inequality itself: the wealth GINI coefficient. Specifically, the exempt fraction of national wealth equals GINI / 2. With the current U.S. wealth GINI at 0.83, this means 41.5% of total national wealth is exempt from taxation.

This creates a self-correcting system: as inequality rises, the exemption rises with it, automatically shifting more of the burden to the top. As inequality falls, the exemption falls too, distributing responsibility more broadly across a healthier economy.

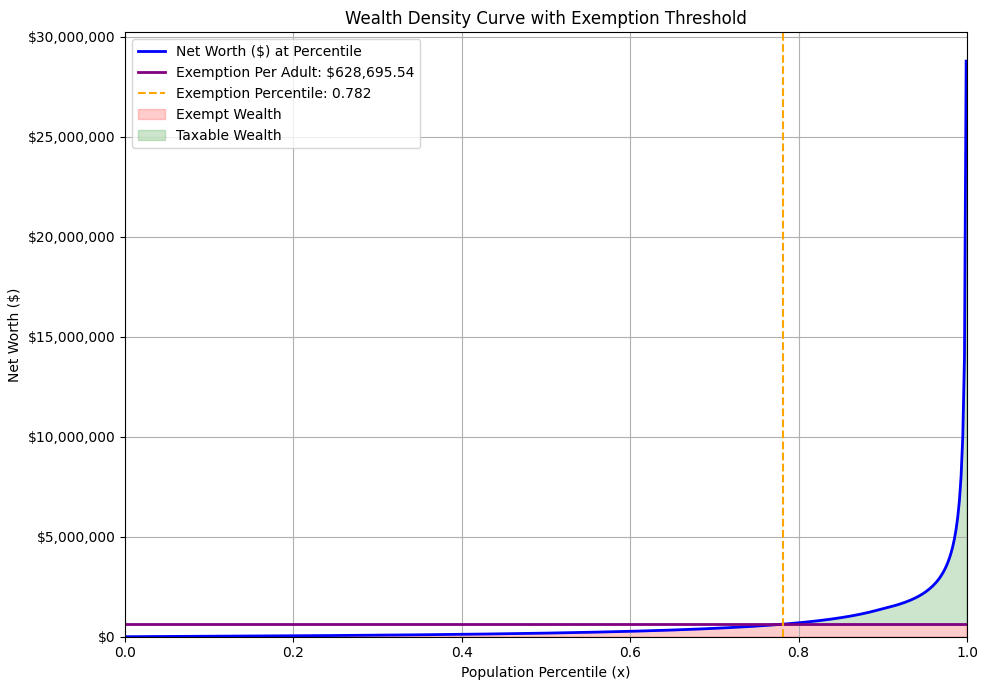

That number is $628,695.

The vertical orange line marks the exemption percentile at 0.782. This means 78.2% of the adult population—everyone to the left of that line—falls entirely within the exempt zone, paying absolutely nothing. The entire tax burden falls on the wealthiest ~22%, the group represented by the green shaded area where the wealth curve rockets upward. This is fairness, visualized.

Anyone with a net worth below this amount pays nothing. Above it, you pay tax only on the portion that exceeds the exemption, at the 8% S&P benchmark rate. We can visualize this to see who actually contributes.

Let That Sink In

Let’s pause for a moment and be perfectly clear about what this model demonstrates. With this system:

At our current wealth distribution, an adult with as much as approximately $628,000 in assets pays zero tax—over $1.25 million for a married couple.

The tax rate matches the S&P 500’s long-term average return. This means anyone above the exemption only needs to invest in an index fund to maintain their wealth. Beat the benchmark, and your wealth actually grows. This is the meritocracy: skill and contribution are rewarded, while idle wealth gradually returns to the economy.

The system is self-correcting: higher inequality automatically raises the exemption, protecting more of the middle class while shifting burden to the top.

And yet, with this simple and fair structure, we don’t just fund the entire U.S. federal budget—we generate a surplus. At current parameters, the system would collect $7.84 trillion, exceeding the $6.66 trillion budget by over $1 trillion. That surplus goes directly toward paying down the national debt.

It’s a system that doesn’t penalize the middle class or even the aspiring rich. It doesn’t destroy wealth; it rewards its productive use. And it fully funds our society’s needs with a level of simplicity and fairness our current tax code can’t even imagine.

The Unexpected Benefits: A System That Works for Everyone

Beyond its core function, the Meritocracy Tax brings a cascade of secondary benefits that radically simplify our economy and realign it with American values.

It Rebuilds Trust. For generations, our tax code has been a maze of complexity and loopholes, feeding the narrative that the system is rigged for the rich. This model replaces that with something simple, stable, and transparent. By making the rules clear and the code open-source, we restore faith that everyone is playing by the same set of rules.

It Aligns Personal Success with the Public Good. The benchmark system creates a powerful incentive for wealth to be used productively. Passively hoarding wealth means it will shrink over time relative to the broader economy. To preserve or grow wealth, it must be invested—funding new businesses, creating jobs, and driving innovation. This aligns individual financial incentives with the societal goal of a dynamic and growing economy.

It Eliminates Lobbying for Tax Favors. With no special tax classes, loopholes, or industry-specific incentives, the multi-billion dollar industry of lobbying Congress for tax breaks simply vanishes. This removes a primary source of political corruption.

It Frees the Market. Libertarians and free-market capitalists should love this system. It wipes out virtually all forms of market distortion created by the tax code. There are no special tax classes for capital gains, no loopholes, and no incentives for one industry over another. It’s a fair, flat tax on extracted wealth, allowing the market to operate on its own merits.

It Radically Simplifies Governance. The current 70,000-page tax code becomes obsolete. It could be replaced by a few paragraphs of legislation and a few thousand lines of open-source code. The multi-billion dollar tax avoidance industry shrinks, freeing up enormous amounts of capital and human talent for more productive work.

It Can Scale Beyond the Federal Government. There is no reason this system should be limited to federal taxes. States and even cities could adopt it to fund their budgets, potentially replacing deeply unpopular and regressive sales and property taxes with a single, fair contribution.

It Removes the Brake on Economic Activity. The current system taxes every transaction—every paycheck, every purchase, every investment. That’s friction on the very activity a healthy economy depends on. The Meritocracy Tax eliminates income and sales taxes entirely. Earn, spend, invest, hire—all tax-free. The only thing that gets taxed is extraction. Activity flows freely; hoarding doesn’t.

It’s Immune to Political Manipulation. No hard-coded rates for politicians to haggle over. No thresholds to quietly adjust in budget deals. The exemption is calculated from wealth distribution data. The rate is anchored to market performance. The math runs itself. Future adjustments happen like Fed interest rate decisions—transparent, data-driven, and instantly visible to everyone.

It Discourages Housing Speculation. Investment real estate returns ~9-11%—barely above the benchmark. Without the current tax advantages (mortgage interest deduction, depreciation, 1031 exchanges), speculators would face a stark comparison: a 1-3% premium over index funds, but with illiquidity, concentration risk, management hassle, and transaction costs. Many would exit, potentially returning inventory to the market and moderating prices for actual homebuyers.

A Nod to the Math

For those wondering about the math behind the curtain, it’s robust and, most importantly, insulated from political manipulation.

We model the wealth data using a composite statistical distribution (a Log-Normal/Pareto blend) and use a root-finding algorithm, Brent’s method, to solve for the precise exemption level.

The key innovation is tying the exemption directly to inequality itself. The exempt fraction of national wealth equals GINI / 2, where GINI is the wealth inequality coefficient (ranging from 0 for perfect equality to 1 for maximum concentration). This creates a powerful feedback loop: as wealth concentrates, the exemption automatically rises to protect more Americans, shifting the burden upward. As the economy becomes more equitable, responsibility is shared more broadly.

The tax rate is then calculated to meet budget requirements, capped at the S&P 500’s long-term average return. This benchmark ensures the system rewards productive investment while remaining self-adjusting to economic realities without legislative meddling. Any future adjustments could be handled much like the Federal Reserve manages interest rates—by an independent body empowered to make small, data-driven changes based on economic needs, not political favors.

We’ll release a full white paper later for the math geeks, but the code is already available on my GitHub, where the README file provides a detailed overview of the underlying math. For everyone else, all you need to know is that the system is built on a foundation of sound, verifiable, and politically insulated mathematics.

Answering the Objections

A proposal this transformative is bound to face criticism. Let’s tackle the most common objections directly, because they all have clear, pragmatic solutions.

Objection 1: “Won’t this cause a market crash when the rich sell stocks to pay the tax?”

The Reality: This is the most serious concern, and we have a two-phase plan to manage it. The plan uses the very same tools the government used to save the bankers in 2008, but flips the script to empower everyday Americans.

Phase 1: The Shock Absorber. To prevent a chaotic sell-off, the Federal Reserve would act as a temporary, stabilizing buyer for high-quality, diversified assets (specifically, shares of major index funds like the S&P 500). This isn’t a bailout; it’s an orderly mechanism to absorb the initial transition, ensuring your 401(k) remains stable.

Phase 2: The Great Rebalancing. The trillions in tax revenue are invested in America—rebuilding infrastructure, funding healthcare, and strengthening the social safety net. For the first time in decades, working families will have enough breathing room to save and invest. As they enter the market, they will purchase shares first from the Fed’s temporary holdings. This creates a virtuous cycle: the concentrated wealth of the few is gradually and organically re-seeded into the hands of the many. This is the trickle-down economy Reagan promised, but that only a fair system can deliver.

One honest acknowledgment: the transition dynamics—how we get from the current system to this one without market disruption—require modeling that exceeds what one person can do in a Substack article. The mechanism described above is plausible but needs rigorous simulation. If you're an economist with the skills to model this seriously, consider this an open invitation. The code is on GitHub. The data is public. Pressure-test it. Break it if you can. That's how good policy gets made.

Objection 2: “Is it fair to force people to sell their stocks or businesses to pay taxes?”

The Reality: We already do this. It’s called the property tax. Every year, homeowners across America must have cash on hand to pay taxes on their primary source of wealth—their home. If they don’t, they risk losing it.

But our system offers a revolutionary improvement. If states were to adopt this model, it could replace property taxes entirely. Imagine that: the Meritocracy Tax could fund state and local needs, including schools, meaning millions of homeowners who pay property taxes today would suddenly pay nothing on their homes.

This would also sever the toxic link between local property values and school funding—a change that would finally end the cycle of wealthy neighborhoods getting the best schools while poorer districts are left behind.

So, not only does our proposal use a long-standing principle, but it also solves one of the most unfair aspects of the current system, all while ensuring the vast majority of homeowners and small business owners are completely exempt.

Objection 3: “It’s impossible to value all wealth accurately. It’s too complex!”

The Reality: The system for this already largely exists. We can leverage the insurance industry. Millions of Americans already report the value of their homes, cars, and other possessions to insurers every year. We can create a straightforward reporting mechanism, similar to a 1099, to track this insured wealth.

Is this system perfect? No, but neither is the income tax system. There will be uninsured assets and attempts to hide wealth, which can be addressed with audits and penalties, just as we do for income tax evasion. For private businesses and other assets without market prices, valuations would follow the IRS's existing methodologies for estate tax purposes, with independent appraisals required above certain thresholds. And consider the workforce we've just freed up. Hundreds of thousands of accountants currently spend their careers navigating a 70,000-page tax code, finding loopholes, and filing byzantine returns. Redirect a fraction of that talent toward wealth verification and fraud detection, and the "impossible complexity" objection evaporates. We're not adding a problem; we're reassigning the solution.

And consider the workforce we’ve just freed up. Hundreds of thousands of accountants currently spend their careers navigating a 70,000-page tax code, finding loopholes, and filing byzantine returns. Redirect a fraction of that talent toward wealth verification and fraud detection, and the “impossible complexity” objection evaporates. We’re not adding a problem; we’re reassigning the solution.

Objection 4: “Won’t the wealthy just take their money and leave the country?”

The Reality: This is the oldest scare tactic in the book. It relies on a quiet assumption: that people can opt out of obligation while keeping all the benefits. That’s not how systems work, and it’s not how the Meritocracy Tax works.

Yes—if someone truly wants to leave, they can. But “leaving” isn’t a magic trick where you keep access to the U.S. market, U.S. legal protections, U.S. customers, U.S. infrastructure, and U.S. financial rails while refusing to pay for them. If you want to exit, it’s a real exit: you lose access to the U.S. market. If you substantially reside here, substantially do business here, or hold wealth here, you’re still in scope. You don’t get to extract value from the largest economic engine on Earth and then pretend you weren’t using it.

This is not unprecedented: the U.S. already enforces extraterritorial tax compliance via FATCA and can cut actors off from the U.S. marketplace/financial system via sanctions authorities.

The funniest part is enforcement. If you replace the tax code with something simple, you don’t need an army of people to interpret it. You suddenly have a surplus of highly trained accountants—so congratulations: we’ve accidentally created the world’s largest anti-fraud workforce.

And even setting enforcement aside, the broader fear just doesn’t match reality. The last time America had anything resembling a fair statutory top-end tax structure—mid-20th century, when top marginal income tax rates were extremely high—the rich didn’t flee. America became the most powerful economic engine in human history. Why? Because a society that invests in its infrastructure and middle class creates the single greatest profit opportunity there is: a huge population of stable, educated, capable consumers and builders.

The Meritocracy Tax supercharges that effect in a way no past system could. It doesn’t just “raise taxes”—it removes drag from the economy. No income tax. No sales tax. No tax friction on work. No tax friction on buying. No maze of loopholes that turns the tax code into a lobbying bazaar. That means the U.S. market becomes the most economically dynamic environment in the developed world: build, trade, hire, invest—without the constant sand in the gears. If you’re trying to create real value, leaving that environment would be irrational.

So who would actually leave? Mostly the people whose “success” depends on the old broken system—the passive rent-seekers, the hoarders, the business failures living off captured advantage instead of productive contribution. And if they choose to make a clean exit, that isn’t a loss. It’s the system shedding dead weight. Everyone else—the builders—will come toward the drag-free American market, not away from it.

Objection 5: “What about bonds and Treasuries? Won’t this kill the safe-asset market?”

The Reality: Treasury bonds and other “safe” investments typically return 4-5%—below the 8% benchmark. Under this system, holding them above the exemption would cause your wealth to slowly shrink. Doesn’t that punish safety-seeking behavior?

First, consider who’s affected. The exemption—over $628,000 for individuals, $1.25 million for couples—is your safety allocation. That’s a substantial cushion that can sit entirely in bonds, Treasuries, or cash with zero tax consequence. Most Americans’ entire “safe” portfolio fits comfortably within it.

Second, consider who’s above the exemption. If you have more than $628,000 in net worth, you’re in the top ~22% of American adults. You can afford a modestly higher-risk profile. The system isn’t demanding you gamble—it’s asking you to invest productively rather than park wealth in instruments that return less than economic growth. Match the market average and you break even. That’s not onerous.

Third, consider the bigger picture. At current parameters, the Meritocracy Tax generates a surplus—roughly $1 trillion annually beyond the federal budget. That surplus pays down the national debt, meaning the government needs to borrow less. Treasury demand from the Fed, foreign governments, and tax-exempt entities remains. The “safe-asset market” doesn’t disappear; it just stops being a tax-advantaged parking lot for the wealthy.

One related question: what about retirement accounts and tax-exempt organizations? Retirement funds—401(k)s, IRAs, pensions—are wealth, and they count toward your net worth. The exemption protects most Americans’ retirement savings entirely; only those with substantial wealth beyond the exemption face any tax consequence. As for tax-exempt organizations like universities, foundations, and churches, reasonable exemptions with caps could exist—but they cannot become unlimited wealth shelters. A church is not a bank vault with a steeple.

Objection 6: “European wealth taxes failed. Why would this be different?”

The Reality: France, Sweden, Germany—they all repealed their wealth taxes. True. And the Meritocracy Tax shares almost nothing with those implementations except that wealth is involved.

European wealth taxes failed because they were poorly designed: low thresholds that hit the middle class, fixed rates set by politicians, layered on top of existing taxes, and fragmented across EU jurisdictions that made relocation trivial.

The Meritocracy Tax is architecturally different:

It replaces, not adds. European wealth taxes were bolted onto existing income and sales taxes—creating legitimate double-taxation complaints while adding friction without removing any. The Meritocracy Tax eliminates income, sales, capital gains, and estate taxes entirely. The result isn’t just simplification—it’s massive economic dynamism. No tax friction on earning. No tax friction on spending. No tax friction on investing. Activity flows freely; only extraction gets taxed.

It responds directly to inequality. European taxes had static thresholds politicians could manipulate. The Meritocracy Tax ties the exemption to the GINI coefficient—a direct measure of wealth concentration. Inequality rises? More wealth gets exempted, and the burden shifts upward automatically. Inequality falls? The exemption falls, and responsibility spreads more broadly. No proxies. No political meddling. The math responds to the problem itself.

It implements actual meritocracy. European taxes had arbitrary rates that could exceed investment returns, making wealth destruction inevitable. The Meritocracy Tax is anchored to market performance. Beat the market? Your wealth grows. Match the market? You stay exactly where you are. Underperform? Your wealth shrinks. That’s not punishment—that’s merit, mathematically enforced.

It’s a true flat tax. Everyone gets the same exemption. Everyone pays the same rate above it. No brackets, no phase-outs, no special treatment. Your contribution is proportional to your stake—period.

It’s a federal system. European wealth fled across EU borders with ease. The U.S. is one jurisdiction—and for those eyeing international exits, see Objection 4.

Saying “European wealth taxes failed, therefore all wealth taxes fail” is like saying “the Ford Pinto crashed, therefore cars don’t work.” Design matters.

Objection 7: “A wealth tax is unconstitutional. The 16th Amendment only authorizes income tax.”

The Reality: This is a real legal question—and one that would need to be resolved. The 16th Amendment authorizes Congress to tax “incomes, from whatever source derived.” A direct tax on wealth might require either a creative legal interpretation (treating it as an excise on the privilege of holding wealth) or a constitutional amendment.

But here’s the political reality: this proposal would reduce taxes to zero for approximately 78% of American adults. It would likely reduce total tax burden for many more—anyone whose 8% of wealth is less than what they currently pay in income, sales, payroll, and property taxes combined.

That’s not a narrow coalition. That’s a supermajority.

Constitutional amendments require two-thirds of Congress and three-fourths of states. Difficult—but not impossible when you’re offering most Americans a tax cut while fully funding the government. In the middle of an affordability crisis, with a proposal that’s mathematically sound and demonstrably fair, the political will could materialize faster than skeptics expect.

The Constitution is not a suicide pact. It’s been amended 27 times when the country needed it. If this system works, the legal path will follow.

Objection 8: “Revenue will crash during recessions—right when government needs money most.”

The Reality: This is how countercyclical fiscal policy is supposed to work.

During economic downturns, wealth declines, so tax revenue declines. The government runs a deficit, injecting money into the economy precisely when private spending contracts. This is stimulus when it’s needed most.

During economic booms, wealth grows, revenue grows, and the government runs a surplus—paying down the debt accumulated during downturns and preventing the economy from overheating.

This isn’t a bug; it’s textbook macroeconomics. The current system tries to maintain stable revenue regardless of conditions, forcing austerity during recessions (exactly backwards) and enabling deficit spending during growth (also backwards). The Meritocracy Tax aligns revenue with economic cycles in exactly the way sound fiscal policy prescribes.

A Final, Radical Thought Experiment: The High Earner Who Pays Zero Tax

There’s one more feature of the Meritocracy Tax to consider—it’s counter-intuitive, radical, and proves the system’s logic. Under this framework, it is entirely possible for a person earning hundreds of millions of dollars a year to pay zero tax.

How? By choosing not to accumulate wealth beyond the exemption amount.

Imagine a high-flying executive or entertainer who makes $100 million in a year. Instead of buying a mansion, they rent one. Instead of owning a private jet, they lease it. They spend lavishly on services, travel, and experiences, injecting every dollar they earn back into the economy.

At the end of the year, their net worth hasn’t increased. They haven’t extracted and hoarded resources from the economy. And so, under the Meritocracy Tax, they owe nothing. Our system doesn’t see a problem with this; in fact, it sees a massive economic engine at work. That person is funding countless jobs—for the pilots, the staff, the artists, the chefs—and creating enormous economic velocity.

This isn’t a loophole; it’s the core feature of the system. It demonstrates that the Meritocracy Tax is not a tax on income, success, or even a lavish lifestyle. It is a tax exclusively on the passive extraction and hoarding of wealth. This re-aligns our incentives away from unproductive accumulation and toward active, productive reinvestment in the American economy.

The conclusion is just below, but before we wrap up, a final thought on how we make this a reality.

If this blueprint for a fairer, simpler America is the kind of solution we need, then join us in building it. The American Manifesto is more than just analysis—it’s the design-and-build firm for a smarter, more meritocratic society. Every subscription helps us develop these detailed blueprints, pressure leaders to adopt real solutions, and arm citizens with the vision to build a better future. Join us, support this work, and let’s build an America that is as fair in its design as our current system is corrupt.

Design. Build. Thrive. The future depends on it.

This Isn’t a Dream; It’s a Blueprint

We stand at a crossroads, facing a future defined by the crises of the present: staggering inequality, crushing debt, and a system so broken it rewards corruption over contribution. The path we are on is not sustainable. It’s a failed experiment that is actively dismantling the American dream.

But decline is a choice, not a destiny. The Meritocracy Tax is the alternative. It’s a self-adjusting system designed to always protect a substantial portion of every American’s wealth, where our nation’s budget is fully funded without new debt, and where the market is finally freed from the corrupting influence of a 70,000-page tax code. It’s a system built not on ideology, but on math, fairness, and merit.

This proposal is more than a policy. It’s a weapon against the despair and decay that authoritarians feed on. A society that provides real opportunity and rewards honest contribution is the ultimate antidote to fascism. By fixing the engine of our economy, we can starve the beast.

This blueprint is a starting point, and it’s only half of the solution. Alongside it, I’ve been developing a reworked, simplified safety net—one that eliminates inefficient means testing and is designed for a future where AI will fundamentally reshape the nature of work. Together, they are designed to solve both the crises of today and the challenges of tomorrow. This is our declaration that we don’t have to accept the broken system we were handed. We can, and must, build something better.

The choice is ours: do we continue to manage the decline, or do we start building the future?

Let’s get to work.

Your Turn — Let’s Refine This Blueprint

This blueprint is a starting point, not a final draft. Its strength comes from being tested, debated, and refined by a community committed to building a better future. I need to hear from you in the comments:

Does the core principle of the Meritocracy Tax—taxing extracted wealth instead of income—make sense to you? What’s the biggest flaw or unforeseen consequence you see in this model?

I’ve addressed eight major objections (market stability, forced sales, valuation, capital flight, safe assets, the European experience, constitutionality, and economic cycles). Which of these rebuttals felt strongest? Which one felt weakest, and how could it be improved?

We’ve discussed several benefits, from eliminating lobbying to replacing property taxes. Which of these benefits is the most powerful selling point? Is there another I missed?

The model uses an 8% max tax rate tied to the S&P 500’s historical average. Does this feel like the right benchmark? What are the pros and cons of anchoring the system to a market index?

Beyond just discussing it here, what’s the first practical step to making an idea like this part of the national conversation? Who needs to see this blueprint the most?

This is a really great sounding plan, honestly.

Thanks for your reply. It will help me to spread your concept among my contacts.